As a journalist covering the financial industry, I am always excited to explore new technologies that have the potential to reshape our monetary landscape. One such technology that has been making headlines in recent years is Bitcoin – a decentralized digital currency that operates on blockchain technology.

Bitcoin has the potential to revolutionize the financial industry by offering a secure and transparent alternative to traditional fiat currencies. It has been praised for its lower transaction fees, faster peer-to-peer transactions, and the ability to operate independently of financial institutions.

In this article, I will explore the basics of Bitcoin, including cryptocurrency, decentralized currency, and blockchain technology. We will also delve into the importance of Bitcoin mining, the significance of having a secure Bitcoin wallet, and the latest developments in the Bitcoin market.

Key Takeaways:

- Bitcoin is a decentralized digital currency that operates on blockchain technology.

- Bitcoin offers lower transaction fees, faster peer-to-peer transactions, and operates independently of financial institutions.

- In this article, we will explore the basics of Bitcoin, including cryptocurrency, decentralized currency, and blockchain technology.

- We will also delve into the importance of Bitcoin mining, the significance of having a secure Bitcoin wallet, and the latest developments in the Bitcoin market.

Understanding Bitcoin: A Digital Currency Powered by Blockchain Technology

Hello, my name is John and in this section, we will delve deeper into the concept of Bitcoin as a digital currency and its foundation on blockchain technology. As we know, Bitcoin is a popular cryptocurrency that operates on a decentralized system, making it different from traditional currencies.

Blockchain technology is the backbone of Bitcoin. It is a digital ledger of transactions that is distributed across a vast network of computers, secured by complex mathematical algorithms. Every transaction on the blockchain is secure, transparent, irreversible and tamper-proof, meaning no one can manipulate or alter the records.

The decentralized nature of Bitcoin is one of its most significant advantages. Because it operates without relying on intermediaries like banks or governments, it allows for lower transaction fees and faster peer-to-peer transactions. It also allows for greater financial freedom, particularly in countries with strict financial regulations.

The use of cryptocurrencies, such as Bitcoin, has been growing in popularity with some businesses now accepting Bitcoin as payment for goods and services. Additionally, some investors are drawn to the potential of making significant profits through Bitcoin trading.

“Blockchain technology is the backbone of Bitcoin.”

However, there are some challenges to consider, such as cybersecurity risks and market volatility. Nevertheless, the potential of blockchain technology and cryptocurrencies to transform the financial industry is enormous, and its growth and impact are only beginning to be felt.

In the next section, we will explore the process of Bitcoin mining, where new bitcoins are created through computational algorithms.

Bitcoin Mining: Unveiling the Creation Process of New Bitcoins

Bitcoin mining is the process by which new bitcoins are created and added to the Bitcoin network. As a decentralized cryptocurrency, Bitcoin relies on a network of computers to maintain and secure its blockchain ledger. These computers, known as miners, are responsible for verifying and recording transactions on the blockchain.

The process of mining involves solving complex mathematical algorithms that require significant computing power. Miners compete to solve these algorithms, and the first miner to solve a block is rewarded with a certain number of bitcoins.

As the difficulty of mining increases over time, specialized hardware, known as Application-Specific Integrated Circuits (ASICs), have become necessary to compete in the mining market. These ASICs are designed specifically for the purpose of Bitcoin mining and are capable of performing the necessary calculations at a much faster rate than traditional CPUs or GPUs.

However, Bitcoin mining has received criticism due to its high energy consumption and potential negative environmental impacts. The energy required for mining operations is significant, as miners consume vast amounts of electricity to power their hardware. Some argue that the environmental impact of Bitcoin mining cannot be ignored and that steps must be taken to reduce its energy consumption.

Despite the potential drawbacks of Bitcoin mining, it remains a crucial component of the Bitcoin network, as it is responsible for creating new bitcoins and maintaining the security and integrity of the blockchain.

Bitcoin Wallets: Safeguarding Your Digital Currency Assets

As someone who invests in cryptocurrency, I know how important it is to keep my bitcoin safe and secure. That’s where a bitcoin wallet comes in. A bitcoin wallet is a digital wallet for storing and managing bitcoin holdings. It securely stores your private keys, which are necessary for accessing and managing your bitcoin.

There are several types of bitcoin wallets, including software wallets, hardware wallets, and paper wallets. Software wallets are the most common and can be accessed through desktop, mobile, or web applications. Hardware wallets are physical devices that offer the highest level of security. Paper wallets are an offline option that involves printing out your private keys on paper.

When it comes to choosing a bitcoin wallet, it’s important to consider security, accessibility, user experience, and compatibility with your operating system. Some popular bitcoin wallets include Ledger Nano S, Trezor, and Coinbase Wallet.

It’s important to remember that, unlike traditional bank accounts, bitcoin wallets are not insured by the FDIC. This means that if your bitcoin wallet is hacked or your private keys are lost, you could lose all of your bitcoin holdings. That’s why it’s important to take security seriously and follow best practices for keeping your bitcoin safe.

Some of these best practices include using strong passwords, enabling two-factor authentication, and keeping your private keys offline. It’s also important to keep your bitcoin wallet software up-to-date and to only use reputable bitcoin wallets and exchanges.

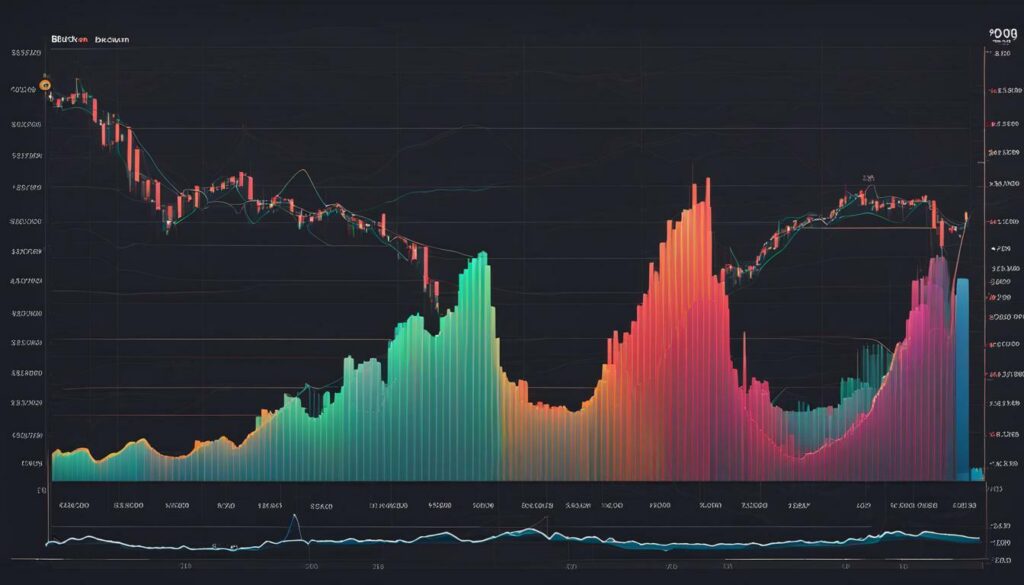

The Volatility of Bitcoin: Exploring the Price Swings

Bitcoin’s price is notoriously volatile, often experiencing significant price swings within short periods. This unpredictability has made it a popular investment but also a risky one.

The factors influencing bitcoin’s price include global demand and supply, regulations, investor sentiment, and media coverage. Any news or development that affects any of these factors can cause the price of bitcoin to go up or down quickly. It is not uncommon for the price to fluctuate by thousands of dollars in a single day.

Bitcoin’s value is also influenced by market sentiment. When investors are bullish on bitcoin, the price tends to rise. On the other hand, when investors are bearish, the price tends to fall.

The price of bitcoin is often compared to gold, as both are perceived as stores of value. However, unlike gold, bitcoins lack intrinsic value, making their value based solely on market demand and supply.

Despite the volatility, many investors still see bitcoin as a viable investment, due to its potential for high returns. However, it is important to consider the risks involved and to only invest what you can afford to lose. It is also essential to stay informed about the latest news and developments in the bitcoin market to make informed investment decisions.

Bitcoin Exchanges: Buying, Selling, and Trading Digital Currency

Bitcoin exchanges are online platforms where users can buy, sell, and trade bitcoins. These exchanges are an important part of the bitcoin market and offer a convenient and accessible way to invest in cryptocurrency. There are two types of exchanges: centralized and decentralized.

Centralized exchanges function similarly to traditional stock exchanges. Users deposit funds, place buy and sell orders, and the exchange matches those orders with other users. These exchanges are highly regulated and offer a high level of security, but they can also be more expensive due to transaction fees and longer wait times for withdrawals.

Decentralized exchanges, on the other hand, operate on distributed ledger technology and allow users to trade directly with one another without the need for intermediaries. These exchanges are less regulated and offer a lower level of security, but they are also more affordable and allow for faster peer-to-peer transactions.

When buying or selling bitcoins on an exchange, it’s important to take security measures to protect your assets. Choose an exchange that has a strong reputation, and enable two-factor authentication to add an extra layer of security to your account. It’s also important to comply with regulatory requirements, such as KYC (know your customer) and AML (anti-money laundering) regulations.

The bitcoin exchange market is constantly evolving, and staying informed about the latest developments and trends is crucial for successful bitcoin trading. Keep track of the latest news on reputable sources and be wary of fake news or scams.

Keeping Up with Bitcoin News: Staying Informed in the Ever-Changing Market

Staying informed about the latest developments in the bitcoin market is crucial for investors and enthusiasts alike. With the ever-changing landscape of cryptocurrencies, it’s important to stay on top of the latest news, trends, and regulatory updates.

One of the best ways to stay up-to-date is to follow reputable sources of bitcoin news. This can include established news outlets such as Forbes, Coindesk, and Bloomberg, as well as specialized blogs and forums.

It’s also important to evaluate news sources, as misinformation and biased reporting can lead to poor investment decisions. When reading articles or watching videos about bitcoin, take note of the author or presenter’s credentials and biases. Look for information that is backed up by reliable sources and objective analysis.

Major events and regulatory decisions can have a significant impact on the price and perception of bitcoin. For example, the announcement of corporate investments in bitcoin by Tesla and other companies led to a surge in the cryptocurrency’s value. On the other hand, regulatory crackdowns on bitcoin exchanges have caused price drops in the past.

By staying informed and keeping up with the latest news, you can make informed decisions about investing in bitcoin and other cryptocurrencies. Whether you’re a seasoned investor or just starting out, knowledge is key to success in the ever-changing world of digital currency.

The Future of Bitcoin: Shaping the Monetary Landscape

As a journalist covering the dynamic world of finance, I have been closely monitoring the evolving landscape of cryptocurrencies. Bitcoin, as the most well-known and widely used cryptocurrency, is poised to play a significant role in shaping the future of the monetary system.

The potential benefits of a decentralized currency like Bitcoin, such as reduced transaction fees, faster and more secure transactions, and greater financial privacy, have made it an increasingly attractive alternative to traditional banking systems.

However, it’s important to note that the value of Bitcoin remains highly volatile and subject to rapid fluctuations. Regulatory uncertainty, market sentiment, and technological advancements will continue to play a significant role in shaping the future of Bitcoin and other cryptocurrencies.

Despite the risks associated with investing in Bitcoin, it’s clear that this innovative digital currency has disrupted the financial industry and will continue to do so in the coming years. As a journalist, it’s my duty to stay vigilant and informed about the latest developments in this rapidly changing market.

FAQ

Q: What is Bitcoin?

A: Bitcoin is a cryptocurrency and decentralized digital currency that operates on a peer-to-peer network called blockchain technology. It allows for secure and transparent transactions without the need for a central authority.

Q: How does Bitcoin mining work?

A: Bitcoin mining is the process of validating and adding new transactions to the blockchain. Miners use specialized hardware to solve complex mathematical problems, and in return, they are rewarded with newly created bitcoins.

Q: What is a Bitcoin wallet?

A: A Bitcoin wallet is a digital wallet that allows you to store, send, and receive bitcoins. It contains a pair of cryptographic keys – a public key for receiving funds and a private key for accessing and spending your bitcoins securely.

Q: Why is the price of Bitcoin so volatile?

A: The price of Bitcoin is influenced by various factors, including market demand and supply, regulatory developments, investor sentiment, and macroeconomic factors. These factors can lead to significant price swings and make Bitcoin a highly volatile asset.

Q: How can I buy, sell, and trade bitcoins?

A: You can buy, sell, and trade bitcoins on specialized online platforms called Bitcoin exchanges. These exchanges allow you to convert your traditional currency into bitcoins and vice versa. It is important to choose a reputable and secure exchange for your transactions.

Q: How can I stay informed about the latest Bitcoin news?

A: To stay informed about the latest developments in the Bitcoin market, you can follow reputable news sources that cover cryptocurrency and blockchain technology. It is also important to evaluate the credibility of news sources and consider the potential impact of major events and regulatory decisions on the price and perception of Bitcoin.

Q: What does the future hold for Bitcoin?

A: The future of Bitcoin is still uncertain, but it has the potential to reshape the monetary landscape. As more individuals and institutions adopt Bitcoin and blockchain technology, it could lead to greater financial inclusion, improved transparency, and increased efficiency in financial transactions.